Crypto and AI: the hidden digital gray market of Xianyu

Source: TechFlow (Shenchao)

Searching for “USDT” on Xianyu returns a blank page. Change the keyword to “selling USD coins,” and a hidden digital black market instantly unfolds.

Sellers use homophones, coded language, and images to evade platform moderation. “If you know, you know” is the local password. Some hide contact details in the corners of images; others post screenshots of exchange logos to signal they are “insiders.”

Crypto assets—highly sensitive and tightly restricted in public discourse—have not disappeared. They have been disguised and folded into a more down-market platform.

“Buying and selling USDT,” “step-by-step exchange app setup,” “overseas IDs for exchange KYC,” “Binance Alpha tutorials”—here, you can purchase what looks like a one-stop shop for crypto trading guidance.

The digital black market extends far beyond crypto: discounted flights, hotel bookings, hard-to-get restaurant reservations, front-row concert tickets, and even “GI AI verification.”

A common line circulating on social media captures it succinctly:

“You can buy almost anything on Xianyu.”

This is hardly an exaggeration.

The Hidden Crypto Trade

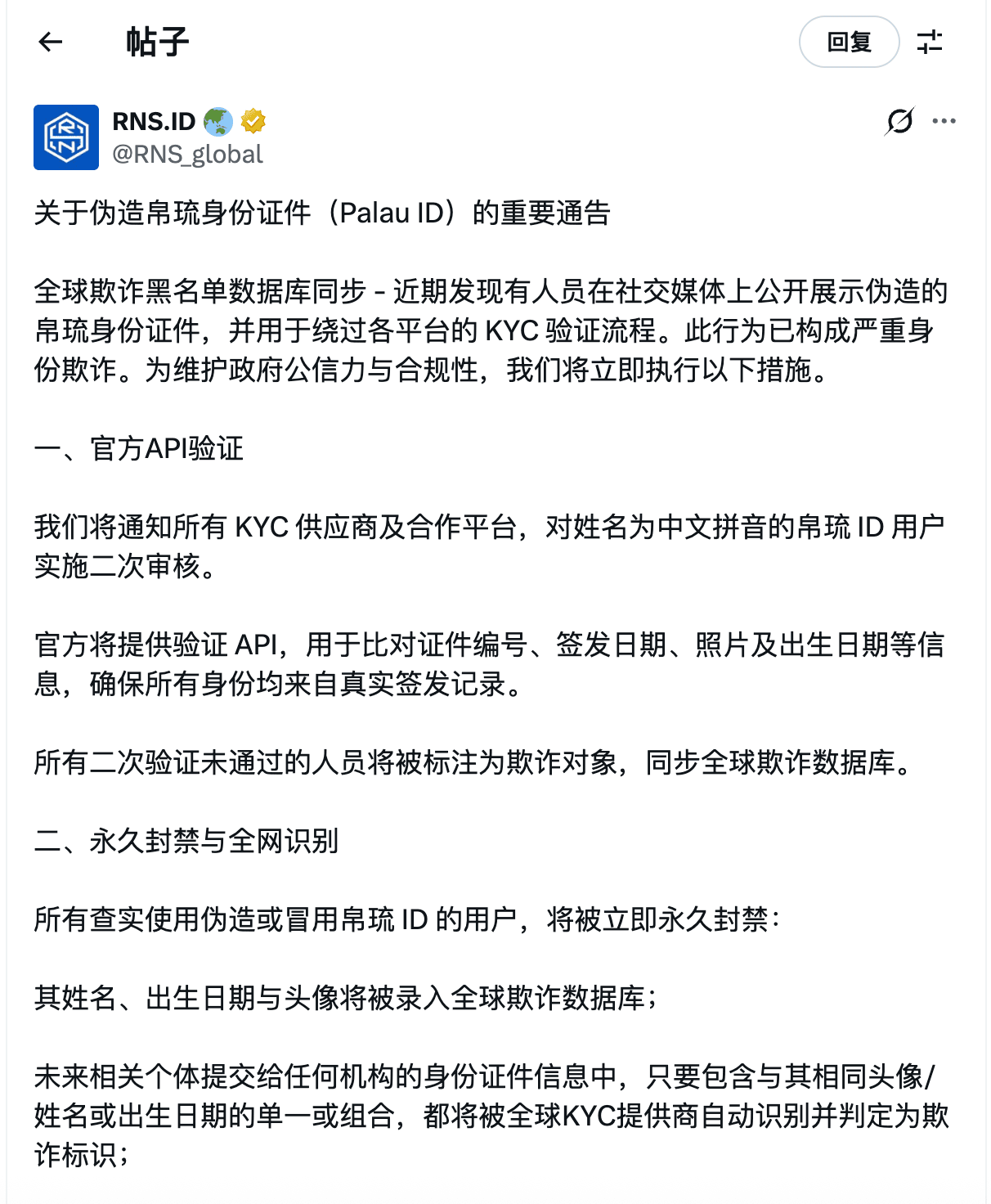

In October 2025, the official X account of the Republic of Palau Digital ID posted a rare announcement—in Chinese.

It warned that forged Palau ID documents were being openly displayed on social platforms and used to bypass KYC checks, constituting serious identity fraud. The RNS.ID authority announced secondary verification for all Palau IDs using Chinese pinyin; unverified users would be flagged as fraudulent and synced to a global fraud database.

Why would a Pacific island nation issue a notice in Chinese? The answer lies in Xianyu’s search results.

Search terms like “overseas identity” or “Palau ID” reveal an underground network selling fake documents, priced from tens to hundreds of yuan, promising “100% pass rate on major exchanges.”

Beyond Palau, IDs from Dominica, Nigeria, and the Philippines are also popular. Forgery quality has improved, with sellers offering customization using buyers’ real photos to pass facial recognition.

But beyond fake IDs for KYC, much of Xianyu’s crypto gray market revolves around zero-cost virtual services.

One account, “Shenzhen Xiaoxia,” once sold a 30-minute Binance/OKX download and setup tutorial for RMB 10 (now removed).

Xiaoxia is no anonymous seller. In crypto circles, the name is well known—a top-tier KOL. Not long ago, industry gossip circulated that he had gone RMB 60 million into debt to buy a luxury waterfront apartment in Shenzhen.

Why would a crypto millionaire personally sell RMB 10 “customer support” sessions on Xianyu?

Because the RMB 10 fee is just bait. The real money comes from referral commissions. Every user who registers via his link can generate ongoing trading-fee revenue—hundreds or even thousands of yuan per month per active user.

The RMB 10 product is a cheap fishing rod. On the other end is a scalable, renewable traffic pool.

If Xiaoxia’s model is an open play, many others profit from information asymmetry more directly.

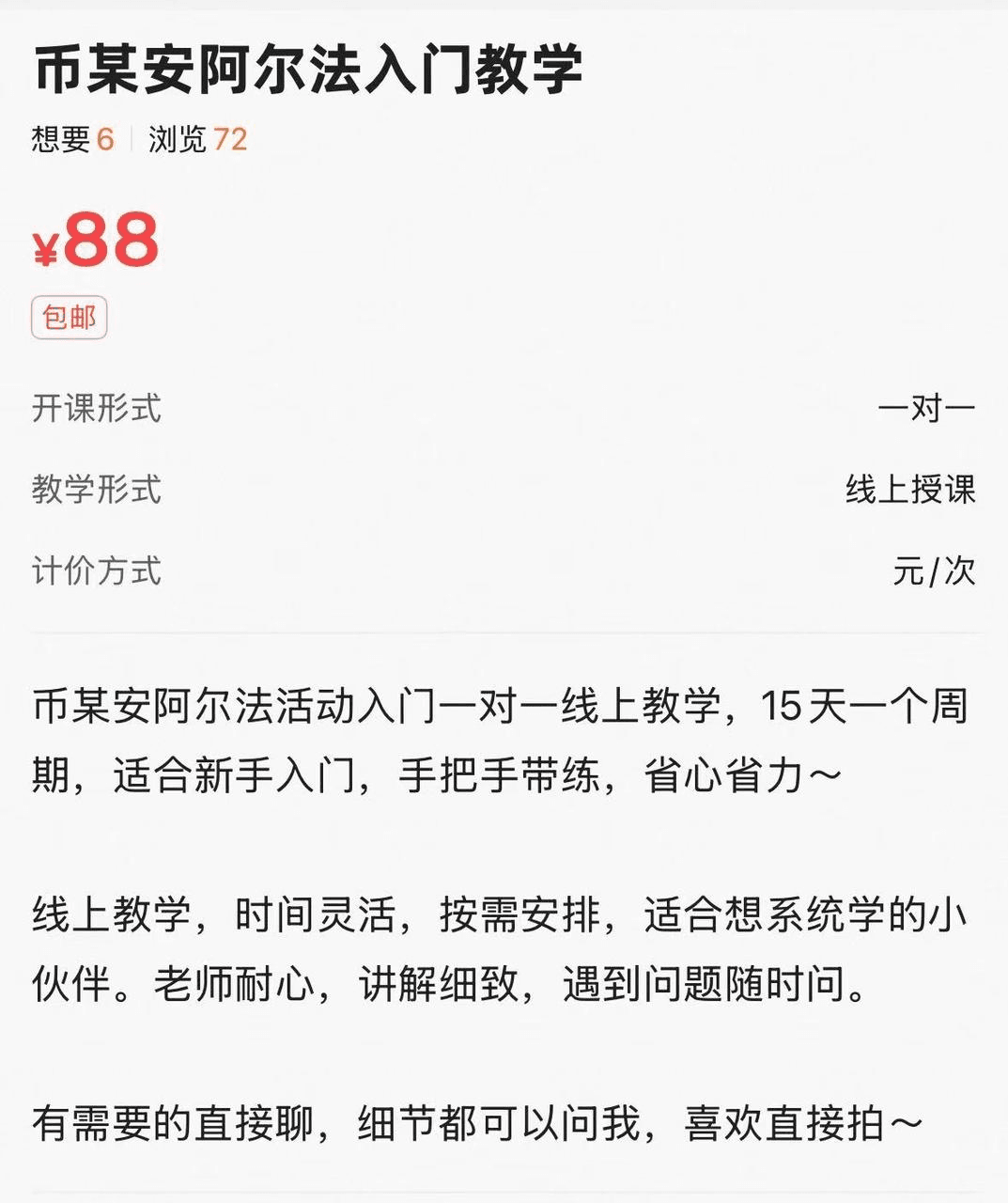

An RMB 88 “Binance Alpha beginner course” promises one-on-one coaching and “hands-on guidance.” “Alpha” typically refers to task-based programs by exchanges that offer potential airdrop rewards.

These methods are widely documented on X and YouTube—often for free. But for many domestic users, the combined barriers of language, network access, and information channels are real. As one buyer commented, “The seller was enthusiastic—much easier than figuring it out myself.”

The AI “Arms Depot”

If crypto trading is just a small darkroom in Xianyu’s folded space, AI commerce is a vast, mass-participation digital arms depot.

When ChatGPT and Claude took the world by storm, an invisible wall went up as well—complex registration, network constraints, and credit-card payments blocked most curious Chinese users. They could see the fireworks, but not the entrance.

Xianyu unexpectedly became the side path around the wall.

The “arms dealers” here offer full-stack services, from beginner to advanced.

The most basic product is an account—pre-registered GPT or Claude accounts sold for tens to hundreds of yuan, often with monthly top-up services.

Want to know which overseas AI tools are hottest? Check Xianyu.

In 2025, when Manus—later acquired by Meta for USD 2 billion—first launched, internal access codes were scarce. On Xianyu, prices jumped overnight from hundreds to thousands, even tens of thousands of yuan; at peak frenzy, listings reached RMB 100,000, helping Manus break into mainstream awareness.

Today, the hottest items are Gemini and ChatGPT.

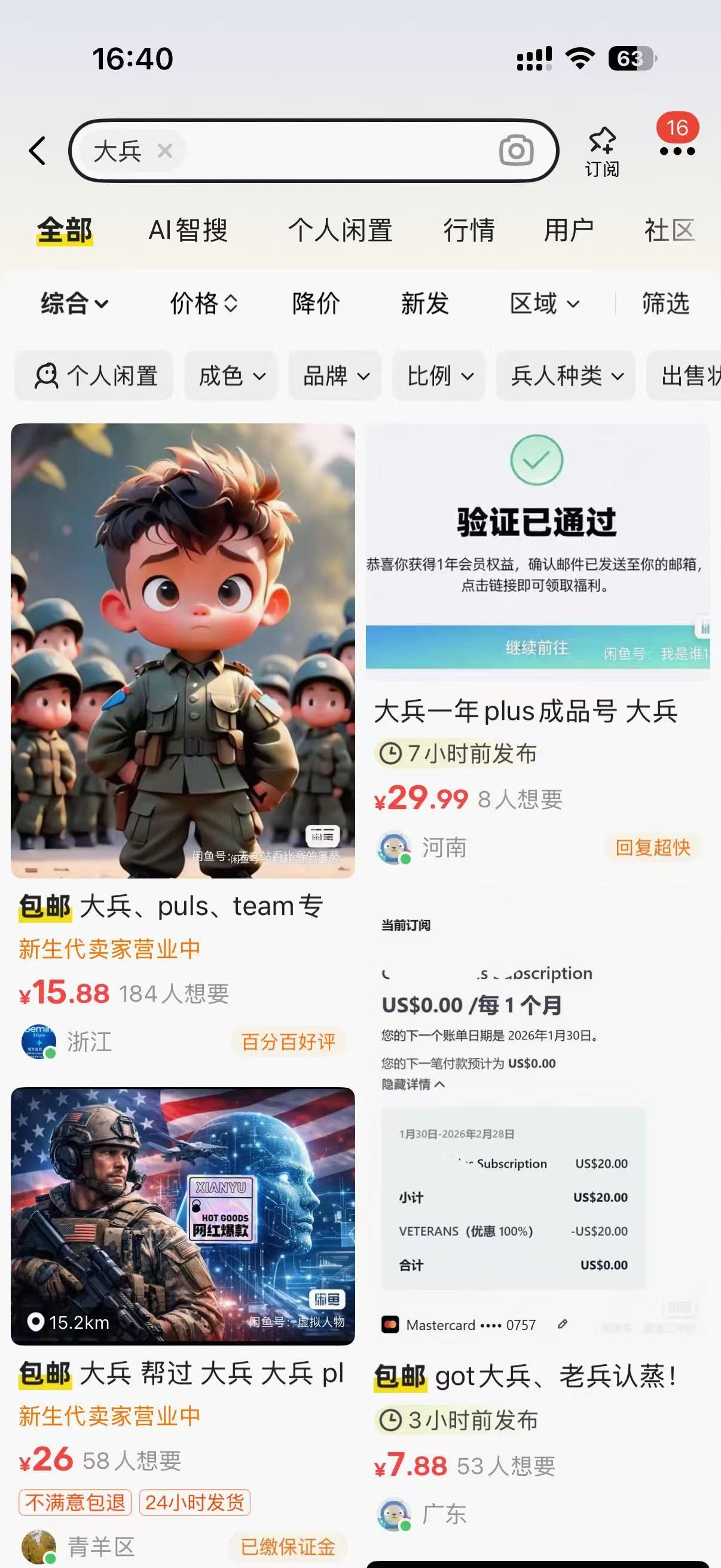

A USD 20 monthly subscription can deter many users. But Google offers students a free year, and OpenAI provides similar benefits to U.S. veterans. On Xianyu, sharp sellers turned this goodwill into a scaled business.

Search “soldier” (大兵), and a strange cyber scene appears: cartoon soldiers or tough-guy avatars, listings titled in shared slang—“Soldier approved,” “One-year Plus account”—priced from a few to dozens of yuan.

One user remarked:

“Xianyu is the largest AI training base in the Chinese-language world. Without it, most Chinese users wouldn’t have access to top-tier global AI models.”

Contradictory, yet painfully accurate.

A platform meant for second-hand goods has inadvertently become the gateway and diffuser of world-class AI in China.

Buying Everything

Crypto and AI are only the tip of the iceberg.

Some joke that “humans have developed less than 1% of Xianyu”—that it’s China’s version of the dark web.

Its “darkness” is less about crime than absurdity. Side hustles and underground services flourish, often becoming viral comedy.

Unpaid wages? One buyer hired “legal aid” on Xianyu—only to see 80 elderly women show up, crying and protesting. Wages paid within three days.

Need to refund a flight? Someone received a “death certificate.”

Xianyu is more than transactions; it may be the most authentic ethnographic field of the Chinese internet.

Wild ingenuity thrives here. It ignores corporate elegance and worships one principle only: problem-solving. When official channels fail or cost too much, grassroots creativity erupts—raw, and often darkly humorous.

The digital black market reflects a real slice of contemporary China: no glossy branding, just human impulses—speculation, shortcuts, laziness, desperation, and survival between the cracks of rules.

But when “solutions” drift deeper into gray zones, the traded object eventually becomes the person.

If hiring elderly women is renting others’ performance, the most dangerous trade is renting your own identity.

“New users wanted for exchanges,” “buying KYC-verified accounts,” “long-term recruitment for QR registrations”—these listings openly package a person’s digital KYC identity for sale. Sellers frame it as “being a landlord in the digital age,” making users believe they’re monetizing idle assets.

In reality, those accounts can become tools for fraud or money laundering.

From buying tutorials, to buying accounts; from outsourcing trouble, to becoming part of it—this bizarre chain closes into a frightening loop.

We start by paying for convenience, and end by trading ourselves for money.

This chaotic digital soil is both grassroots infrastructure—helping ordinary people bypass barriers—and a dark forest full of traps. It proves, in extreme form, that suppressed demand never disappears; it only resurfaces where rules cannot reach, in cruder and riskier ways.

Here, convenience and cost share the same price tag. You think you’re taking a shortcut—only to realize the shortcut may end at a cliff.

You may also like

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…

White House Continues to Negotiate Over Crypto Market Structure Bill

Key Takeaways The White House is pushing for a compromise on the contentious issue of stablecoin yields in…

Billionaire Michael Saylor’s Strategy Acquires $75M More Bitcoin – Is This a Bullish Sign?

Key Takeaways Michael Saylor’s Strategy has expanded its Bitcoin holdings by purchasing an additional 855 BTC for $75.3…

Polymarket Bettors Assign Over 70% Probability of Bitcoin Dropping Below $65K — Are They Correct?

Key Takeaways Polymarket users predict Bitcoin has a 71% chance of falling below $65,000 in 2026, reflecting market…

CFTC Regulatory Shift Could Unlock New Growth for Coinbase Prediction Markets

Key Takeaways Newly appointed CFTC Chair, Michael Selig, aims for a unified federal oversight approach for crypto-linked prediction…

We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin, and Ethereum By the End of 2026

Key Takeaways Perplexity AI predicts XRP may soar to $8 by 2026, fueled by legal victories and supportive…

Current Crypto Price Predictions: An In-Depth Analysis of XRP, Dogecoin, and Shiba Inu

Key Takeaways XRP, Dogecoin, and Shiba Inu are experiencing significant price declines amid geopolitical uncertainties and general market…

Pepe Coin Forecast: Price Appears Dismal, Yet Savvy Investors Rally Behind the Scenes

Key Takeaways Pepe Coin has experienced significant price drops, yet indicators suggest it may soon bottom out, with…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies has reported significant crypto holdings valued at $10.7 billion. The company’s Ethereum holdings…

Crypto Exchanges’ Stock Plunge 60% as Trading Volumes Dwindle – Is the Decline Ending or Just Beginning?

Key Takeaways Trading volumes on major crypto exchanges have drastically fallen, with a nearly 90% drop from October…

Best Crypto to Acquire Now February 2 – XRP, Solana, Ethereum

Key Takeaways Recent market turmoil saw Bitcoin plunge dramatically, affecting all major cryptocurrencies. XRP, Solana, and Ethereum are…

Ethereum Price Prediction: Top ETH Bulls Face $7.6 Billion in Paper Losses as Price Drops Below $2,400

Key Takeaways Ethereum has faced a downturn, dropping 19% below $2,400, resulting in significant paper losses for major…

Shiba Inu Price Prediction: SHIB Just Crashed to a 3-Year Low – Is SHIB Heading Towards Zero?

Key Takeaways Shiba Inu has recently hit a significant low, experiencing a 15% drop that places it at…

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…