From 30% Profit to Losing It All: Beware of the "Greed Trap" in the Crypto Bear Market

Original Article Title: How to survive a bear market in DeFi market neutral

Original Article Author: Santisa, Crypto KOL

Original Article Translation: Felix, PANews

Before delving into the content of this article, let's first consider the following story (or perhaps reality).

An "endless" tariff list is announced. Subsequently, the market crashes, and meme coins collapse.

Your original low-risk "mining farm" yield drops from 30% to nearly Treasury bill levels.

This is unacceptable to you. You had planned to retire with $300,000, earning $90,000 annually from "mining." Therefore, the yield had to be high.

So, you start exploring down the risk curve, chasing an imagined level of yield as if the market would favor you.

You swapped blue-chip projects for unknown new projects; you increased your yield by deploying assets to high-risk new fixed-term protocols or AMMs. You started feeling smug.

Weeks later, you begin to question why you had been so risk-averse in the first place. It was clearly a "safe and reliable" way to make money.

Then, a surprise comes.

The ultra-liquid infrastructure trading project you entrusted your life savings to, custody, leverage, L2-wrapped, collapses, and now your PT-shitUSD-27AUG2025 has lost 70%. You received some airdropped governance tokens, only for the project to be abandoned months later.

While this story is exaggerated, it reflects the reality that unfolds repeatedly during a bear market when yields are compressed. Based on this, this article will attempt to provide a survival manual for the yield bear market.

People strive to adapt to the new reality, facing market crashes, they increase risk to compensate for the yield shortfall while ignoring the potential costs of these decisions.

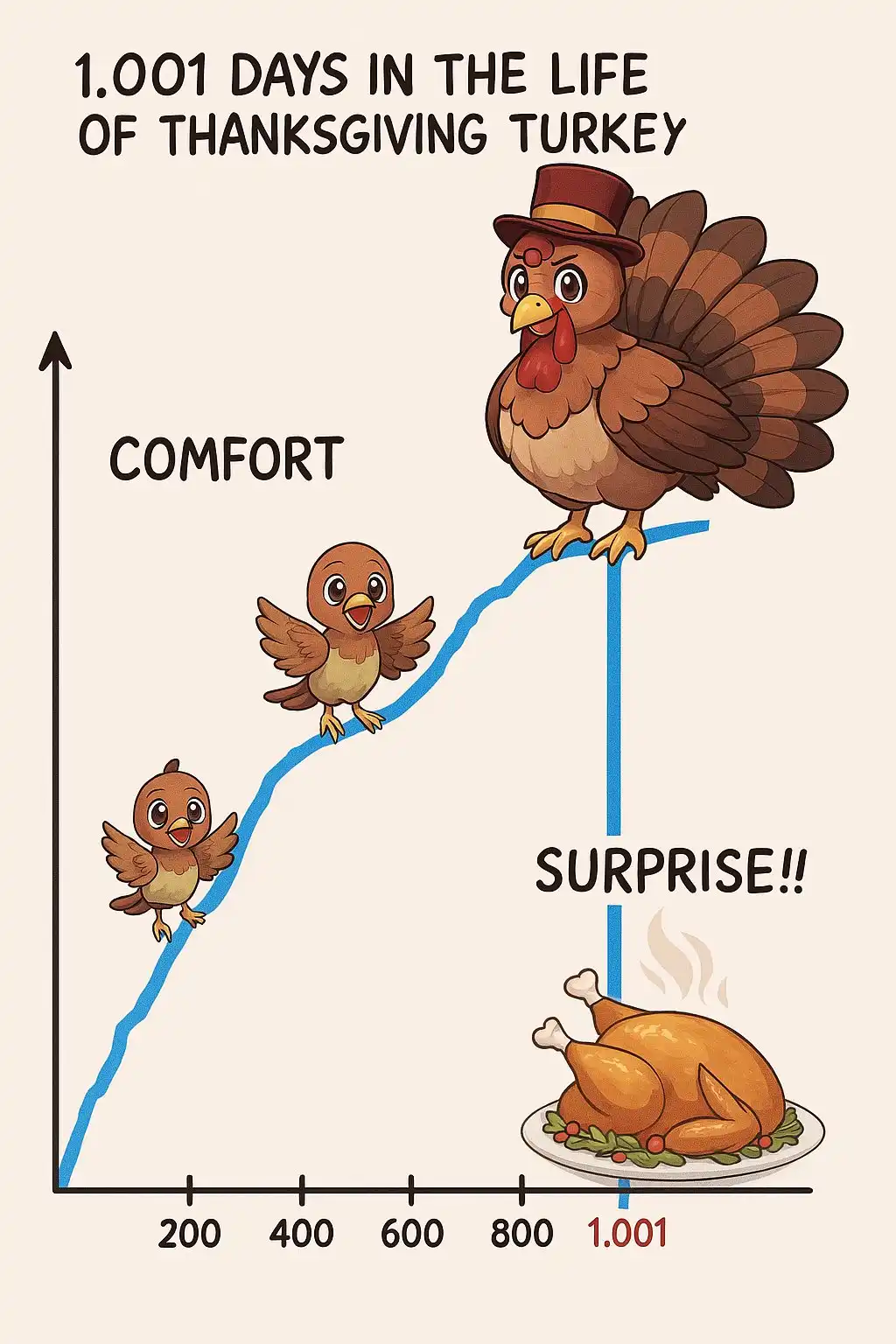

Market-neutral investors are also speculators, with their advantage lying in finding unadjusted rates. Unlike their directional trading counterparts, these speculators face only two outcomes: either making a little profit every day or losing a substantial amount in one go.

Personally, I believe that crypto market-neutral rates become severely mismatched during an uptrend, offering alpha higher than their true risk, but conversely during a downtrend, they provide returns lower than the risk-free rate (RFR) while taking on a significant amount of risk.

Clearly, sometimes you need to take risks, and sometimes you need to mitigate risks. Those who fail to see this will become someone else's "Thanksgiving dinner".

For example, at the time of writing this article, AAVE's USDC yield is 2.7%, and sUSD's yield is 4.5%.

· AAVE USDC bears 60% of the RFR while also bearing smart contract, oracle, custody, and financial risks.

· Maker, while bearing smart contract and custody risks and actively investing in higher-risk projects, bears a fee of 25 basis points above the RFR.

When analyzing the interest rate of a neutral investment in the DeFi market, you need to consider:

· Custodial risk

· Financial risk

· Smart contract risk

· Risk-free rate

You can assign an annual risk percentage to each type of risk, then add the RFR to determine the "risk-adjusted return" required for each investment opportunity. Anything above this rate is considered alpha, while anything below is not alpha.

A recent calculation found that Maker's risk-adjusted required return is 9.56% for a fair compensation.

Maker's current rate is approximately 4.5%.

Both AAVE and Maker hold Tier 2 capital (about 1% of total deposits), but even with substantial insurance, depositors should not accept yields below the RFR.

In the era of Blackroll T-bills and regulated on-chain issuers, this is the consequence of lethargy, key loss, and foolish capital.

So what should you do? It depends on your scale.

If your portfolio scale is small (less than $5 million), there are still attractive options. Check out protocols that are more secure in all chain deployments; they often provide incentives on some lesser-known chains with lower TVL or engage in basic trading on high-yield, low-liquidity perpetuals.

If you have a large amount of capital (over $20 million):

Buy short-term Treasury bills and wait for things to evolve. The favorable market conditions will eventually return. You can also look into OTC trading; many projects are still looking for TVL and are willing to significantly dilute their holders.

If you have LP, let them know, even let them exit. The on-chain treasury bond is still below the real trade. Don't let the untuned risk-return ratio cloud your judgment. Good opportunities are obvious. Keep it simple, avoid greed. You should stay here for the long term, manage your risk-return properly; if not, the market will take care of it for you.

Related Reading: Comprehensive Data Analysis: Where Did the Funds Flow Behind the $100 Billion Growth of Stablecoins? Shitcoins didn't rise, where did the money go?

You may also like

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

Earn

Earn