GRIFT Doubling Down: Why is DeFAI the Best Post-Crash Bounce-back Bet?

Original Article Title: Everything is Fine with DeFAI

Original Article Author: Defi0xJeff, Head of Steak Studio

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: DeFAI is attracting market attention, especially in the abstraction layer and automated trading agent space. Despite facing challenges such as limited research tools and user onboarding issues, with a strong vision and professionalism, it is expected to lead the 2025 AI agent bull market, focusing on analytical tools and practical agents to avoid emotional trading.

Below is the original content (slightly reorganized for readability):

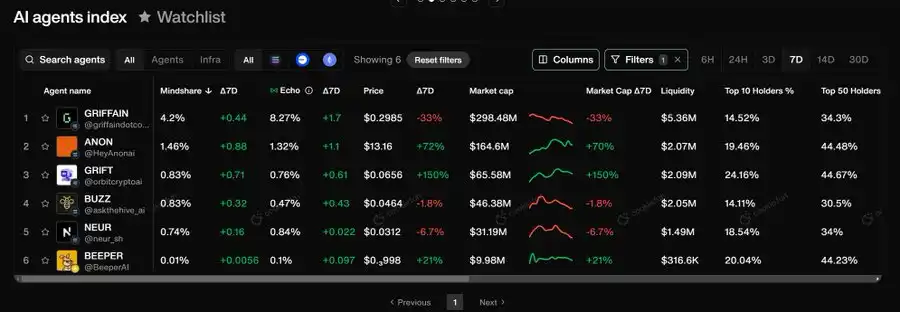

Market sentiment has become extremely bearish across all AI agent subcategories, with one narrative being the exception: DeFAI.

DeFAI is primarily focused on the abstraction layer category and has performed well during market downturns, with two projects showing particularly strong performance in the past week:

· GRIFT / orbitcryptoai—Market Cap $65M (Past 7 Days +150%)

· ANON / HeyAnonai—Market Cap $161M (Past 7 Days +70%)

Orbit

Orbit continues to show strong momentum, with its unique features setting it apart from its peers. The latest features include:

· USDC Transfer Agent: Consolidates USDC balances from multiple chains into a unified balance and transfers to a designated wallet for payments (future support for any token).

· Data Hooks: Users can automate trades and on-chain tasks, such as "swap [x] USDC every minute on Solana until SOL market cap reaches [x]."

With integration capabilities covering 117+ chains and 200+ protocols, Orbit is positioning itself as the "financial assistant for billions of AI agents"—aiding agents and humans in seamless payments, task completion, and interaction through the Orbit tech stack protocols.

The market is beginning to equate GRIFT's pricing with other major competitors.

HeyAnon

HeyAnon, led by danielesesta, has recently taken a differentiated path through some new announcements:

· Gemma: a Research Assistant Agent aimed at transforming massive on-chain and social data into actionable visual elements.

· AUTOMATE: a TypeScript framework developed specifically for DeFAI to accelerate the HeyAnon ecosystem's development process.

HeyAnon's vision is to become a universal intelligence layer supporting multi-step transactions, governance, and data analysis while ensuring on-chain transaction security and transparency. AUTOMATE emphasizes pattern-based typed interactions to prevent developers from deploying misconfigurations.

Partners include arbitrum, base, avax, BNBCHAIN, iota, KAVA CHAIN, and SonicLabs. The team has also initiated a grant program through a DAO proposal, utilizing 2% of ANON and a $1 million USDC treasury reserve to drive integrations and developer activities.

Although ANON quickly surpassed a $100 million market cap, the current slow uptrend reflects a cautious pricing attitude during the market downturn.

Griffain

griffaindotcom remains the largest project by market cap in the abstraction layer space ($330 million), despite a 21% pullback in the past 7 days. Why is this happening? It is currently uncertain... it could be that capital is rotating from higher market cap DeFAI projects to lower-cap projects, or it could be because Griffain focuses on a universal abstraction layer rather than the DeFi and transaction-focused solutions like its peers.

Feature/Focus Differences Summary

· Orbit ➔ Tailored for cross-chain transactions and DeFi operations (currently with the highest number of integrations).

· Anon ➔ Focuses on data (signals/insights), transactions, and DeFi operations, driving developer community building through L1/L2 partnerships and grants.

· Griffain ➔ Provides a universal abstraction layer for Solana, positioned as the "agent of agents," and features dedicated agents such as an airdrop tool, token launcher, burn mechanism, coffee robot, and NFT agent.

After testing these protocols, my favorite is still slate ceo.

The use cases I rely on for this abstraction layer include:

· Basic on-chain operations: transfers and swaps.

· Automation: sell [x] every hour until the next 10 days.

· Advanced conditional trades: when A reaches [x] market cap and B reaches [x] market cap, swap $5,000 worth of A and B.

Slate does not have a native token, but I really like its product. The downside is that it only supports EVM chains and requires manually depositing gas fee tokens to use. Currently, I am using it to automate trades on Base.

Abstraction Layer Challenges

· Limited research tools: Many platforms offer a "research agent," but the functionality is limited compared to a real analytics dashboard.

· Token recognition issues: Some platforms fail to recognize token symbols, forcing users to manually input token addresses.

· Limited DeFi use cases: High-quality DeFi protocols are often not integrated or lack fundamental data like TVL, APR%, or risk assessment for users to make informed decisions.

· Poor user onboarding: The interface and instructions are unclear, sometimes requiring users to manually select agents to execute commands rather than providing a seamless centralized interface.

Conclusion on Abstraction Layer

For most use cases, traditional tools are still superior. Here are my recommendations:

· Use professional analytics tools for research: Make better use of these tools.

· Use DefiLlama to get metrics, yields, and DeFi-related insights.

· Use AcrossProtocol for L2 bridging.

· Use wormhole for bridging between Non-EVM and EVM ecosystems.

Despite the somewhat clumsy experience, I still have high hopes for DeFAI, especially the abstraction layers, as their vision is to simplify the DeFi user experience. This vision (and its execution) is crucial for achieving mass adoption and attracting mainstream users.

Automated Trading Agents

The Automated Trading Agent category is experiencing a significant drawdown, with TONY only dropping by 8%, performing the best in the last 7 days.

Highlights Beyond the cookiedotfun Dashboard:

·CATG / boltrade ai—Focuses on analyzing intelligent trader signals and trading agents.

·LAY / loomlayai—Provides an agent ecosystem with a no-code building tool aimed at API/skill integration, focusing on trading strategies.

·BULLY / dolion ai—Expands from personalized agents to trading strategies.

The performance of these projects has all experienced significant drawdowns. The most worthy projects to buy into will have the following characteristics:

·Performance: Capable of generating alpha returns and possessing a robust PnL.

·Verifiability: Performance data tied to wallet addresses.

·Participation: Users can share in the benefits gained by the agent.

This narrative is still in its early stages. Currently, the only agent with verified performance is BigTonyXBT. Other agents are either still in the backtesting phase or operating behind the scenes, lacking transparency.

Summary

The current pricing of DeFAI is higher than other subdomains because it is fresh, has a strong vision, and benefits from danielesesta's promotional expertise. However, there are still challenges in practice. To achieve alpha returns, it is recommended to focus on analytical tools (like the five tools mentioned) and utility-focused agents such as:

·aixbt agent

·unit00x0

·kwantxbt

·AgentScarlett

·tri sigma

Automated trading agents have not yet gained enough momentum, and major trading agent ecosystems like Almanak have not yet launched. When the market bounces back, DeFAI (Layer of Abstraction and Automated Trading Agents) may lead the market due to its strong narrative positioning.

Prepare ahead, stay secure, avoid emotional trading. Focus on long-term strategies, and most importantly, be prepared to seize opportunities when the rebound comes. The 2025 AI agent bull market is on the horizon, destined for brilliance!

You may also like

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

Believing in the Capital Markets - The Essence and Core Value of Cryptocurrency

Polymarket's 'Weatherman': Predict Temperature, Win Million-Dollar Payout

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

A nearly 20% one-day plunge, how long has it been since you last saw a $60,000 Bitcoin?

Raoul Pal: I've seen every single panic, and they are never the end.

Key Market Information Discrepancy on February 6th - A Must-Read! | Alpha Morning Report

2026 Crypto Industry's First Snowfall

The Harsh Reality Behind the $26 Billion Crypto Liquidation: Liquidity Is Killing the Market

Why Is Gold, US Stocks, Bitcoin All Falling?

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Trump-Linked World Liberty Financial Under Scrutiny Following $500 Million UAE Stake

Key Takeaways A U.S. House investigation is examining a $500 million UAE stake in Trump-related World Liberty Financial.…

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

Believing in the Capital Markets - The Essence and Core Value of Cryptocurrency

Polymarket's 'Weatherman': Predict Temperature, Win Million-Dollar Payout

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

Earn

Earn