The Trilemma of the New Crypto Economy: The Intersection of Energy, Cutting-Edge Technology, and Stablecoins

Original Article Title: Energy, Frontier, Stablecoin

Original Article Authors: @ManoppoMarco, @primitivecrypto Investors

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: This article explores the current status and future direction of the cryptocurrency industry, suggesting that innovation in the crypto space has become flat, with new technologies and projects failing to bring breakthroughs. The author believes that true innovation should combine the core features of crypto, such as incentive mechanisms, asset liquidity, and seamless transfer, to address macro issues. By integrating energy, frontier technology, and stablecoin, the crypto industry can be propelled to a higher level of development.

The following is the original content (slightly reorganized for clarity):

This is the first part of an exploratory paper series that I will be writing in the coming weeks.

Is the crypto industry getting boring... or growing? Over the past few months, Crypto Twitter's mood has been mixed, with both excitement and fatigue, mainly due to two reasons:

· The trench is dead.

· The institutions are here to take your lunch money.

The former means that the rebellious, cypherpunk-style innovation is no longer as prevalent in the crypto industry as it was in the past. Since DeFi unlocked our imagination in 2019, there has been no real 0 to 1 innovation in our field. Of course, blockchain has become faster, and we are all working hard to help traditional finance save 30 basis points through asset tokenization (which is a trillion-dollar opportunity!), but it can also be said that the original spirit of crypto is slowly fading away.

The latter means that the current crypto space is filled with MBA graduates and professional protocol hoppers (I swear I will make PPH a real term), who now dominate our field. These professionals, hey, I bet some senior managers of big protocols haven't even tried issuing their own coin on PumpFun.

Overall, observing all this has made me start thinking about which possible new verticals we can explore to get my CT friends excited again.

Frankly, I don't think what's happening in the crypto industry is bad or boring; it's just the natural progression of business and tech cycles within a maturing vertical.

But hey, maybe I'm too pragmatic. So, what's new?

New virtual machines, new blockchains, and new Ponzi economics will continue to attract funding, especially in the early stages. Because crypto is still the world's best capital market. Ask any Web2 VC friend of yours how things are on their end, and you might think we're no longer in a bear market.

But these optimizations have become somewhat boring; even though they still bring returns to early investors, they haven't unlocked new mechanisms or driven new business models that propel our industry forward.

Therefore, this article is an attempt to imagine things that could drive the industry forward.

My assumption is that the answer lies in the combination of the following three intersections:

· Energy

· Cutting-edge Technology

· Stablecoins

Let's dissect these three concepts.

Triumvirate

The original meaning of "Triumvirate" was the rule of three men—referring to the informal alliance of Caesar, Pompey, and Crassus in 60 BC. If you think I'm a bit old-fashioned, go with your gut.

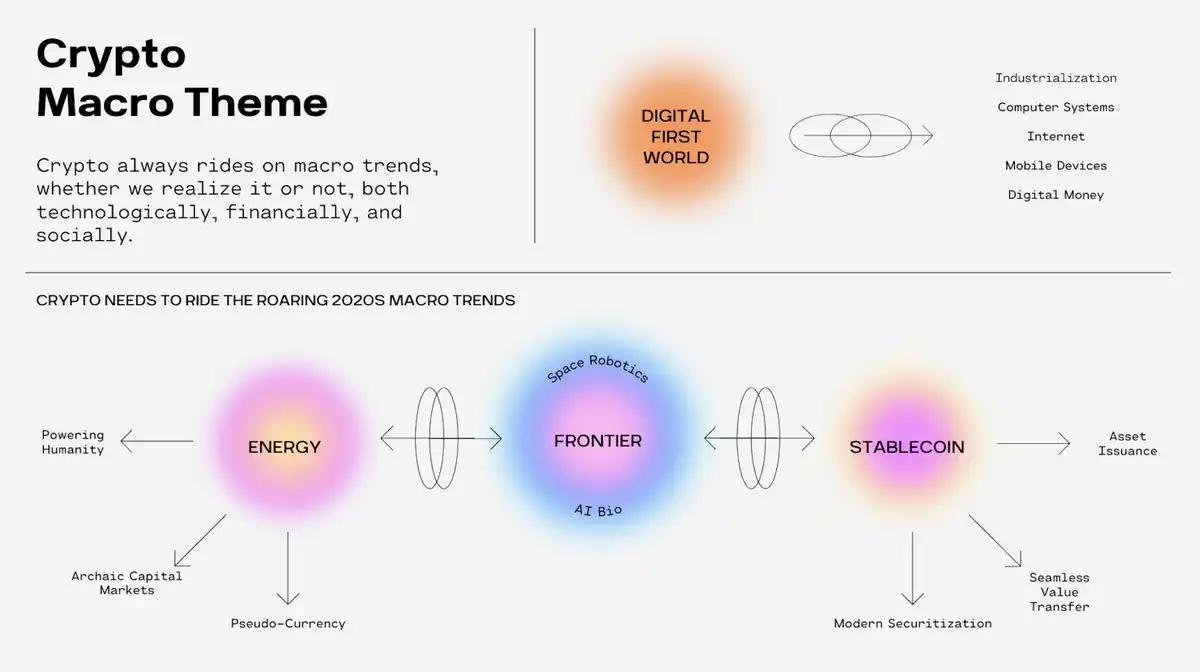

I believe that crypto is fundamentally a macro asset. The technological and capital market value that crypto provides is most effective when combined with macro trends. Digitalization was the earliest trend that brought crypto into our world. In an increasingly digital world, there has to be a native way to exchange value -> hence crypto.

Now, the world is undergoing several macro trends:

· Energy: Demand for more energy

· Cutting-edge Technology: Demand for technological advancement

· Stablecoins: Demand for seamless value transfer

These three constitute the crypto Triumvirate. By properly combining these three verticals, crypto can be propelled to the next level.

I'll be the first to admit that, taken individually, this concept is not groundbreaking. Some funds have already started focusing on the convergence of crypto and energy, such as @uraniumdigital_ and @daylightenergy_'s recent funding rounds; while some have explored the combination of crypto and cutting-edge technology, like @openmind_agi and @Spacecoin_xyz.

The key is, when you combine these three elements, what kind of product and incentive mechanism flywheel can you ignite.

· A DeFi project without asset issuance? Boring.

· A stablecoin without real-world use case? Oversaturated.

· Cutting-edge technology without a crypto flywheel? Pointless.

In Summary

How to leverage the best attributes of crypto: incentive mechanisms, populism, and seamless asset creation/transfer, and combine them with the most interesting problems of our generation — not just for the sake of a forced narrative, but because the nature of crypto can truly create a better product and incentive flywheel for the problem you are solving.

I once read a saying, stripped of everything, there are only two ways to make money:

· You create value and convert it into money

· You facilitate the flow of funds and charge a fee

I believe that crypto, if done right, will embody both methods (1) and (2) simultaneously.

In the second part, I will explore the first-generation existing mechanisms/business models of these tripartite political projects and consider what might happen when they are combined.

You may also like

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

Coinbase UK Executive Declares Tokenised Collateral a Mainstream Financial Force

Key Takeaways Tokenised collateral is transitioning from its initial experimental stages into becoming core infrastructure within financial markets.…

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Earn

Earn